Ship from Canada to the U.S. Without Tariff Stress

Shipping from Canada to the U.S. can feel complicated, but it becomes easy once you understand a few basic ideas: de minimis rules, tariffs, and how tools like Zonos calculate fees. This guide breaks everything down in plain language so anyone can follow along.

1. What Is the De Minimis Rule?

The U.S. has a rule called de minimis. It decides whether a package entering the United States must pay duties.

- In the past, items worth under USD $800 often entered duty-free.

- Recent policy changes mean many courier shipments (like UPS, FedEx, DHL) no longer get automatic duty-free treatment.

- Postal shipments (Canada Post USPS) still follow a different system and may be cheaper for lightweight consumer goods.

Takeaway: The de minimis rule is not guaranteed for courier shipments anymore, but postal shipments still use a simplified system.

2. What Are Tariffs?

A tariff is a tax charged when goods cross a border.

There are two main types of tariffs when sending items from Canada to the U.S.:

A. Courier Tariffs (UPS, FedEx, DHL)

- The item is assigned an HS code (a global product classification).

- The U.S. applies its standard tax for that product.

- Extra fees may apply depending on where the item was made.

B. Postal Tariffs (Canada Post → USPS)

Postal packages use a simpler tax called an IEEPA tariff. Instead of looking up a detailed product code, a percentage is applied to the items value.

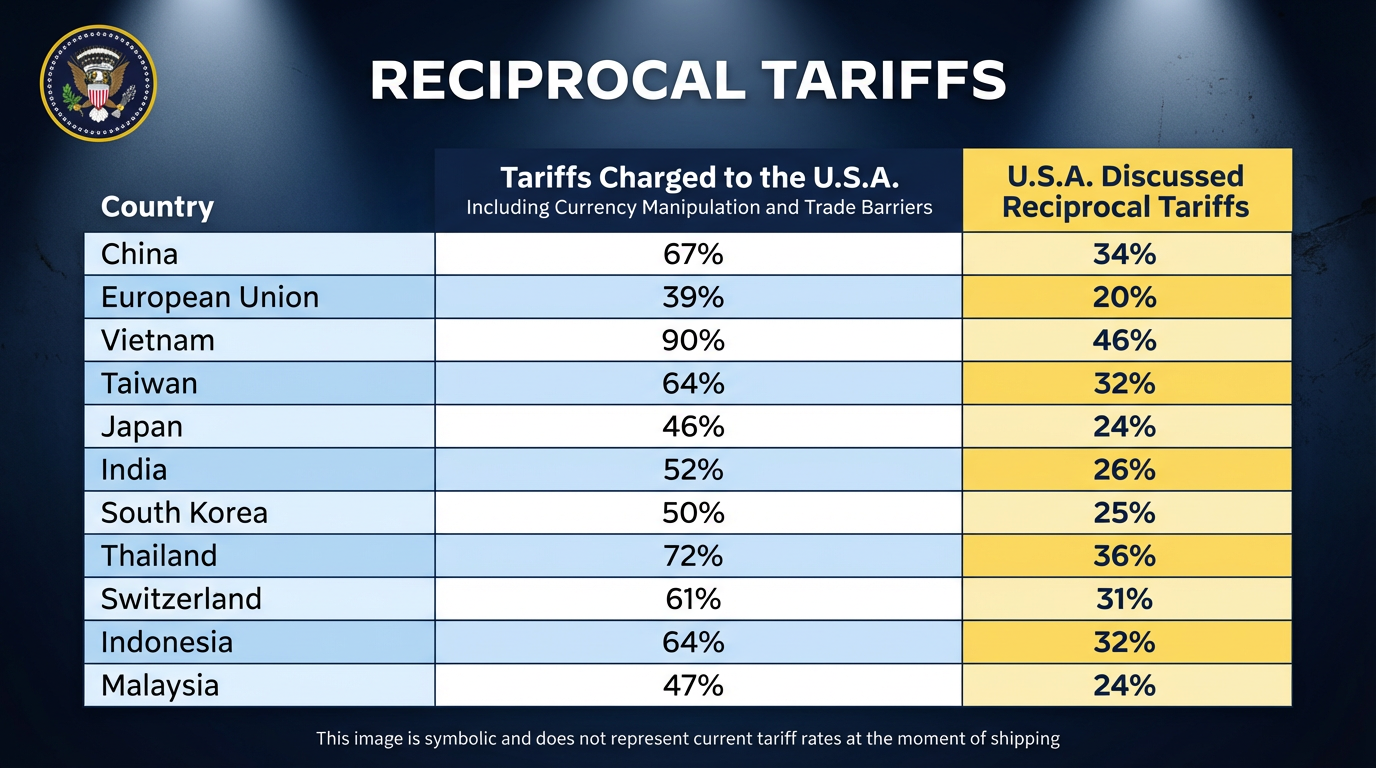

Example: An item from China might use a 30% IEEPA rate.

Takeaway: Couriers use detailed tariff rules; postal shipments use simpler percentage-based tariffs.

3. What Is Zonos and How Does It Help?

This is the process that we use to calculate tariffs

Zonos is a tool that calculates duties and fees automatically. Many shipping platforms use it.

For Canada Post shipments, the calculation works like this:

- log into your ShipByMail account. Your U.S. shipping information will be managed through your dashboard.

- Send your items to your ShipByMail suite in Canada. Once received, the system will prompt you for item details needed for customs.

The result shows exactly what you will pay before shipping.

Takeaway: Zonos makes it easy to know your taxes ahead of time.

4. How to Choose the Best Shipping Method

Choose Postal (Canada Post) if:

- You want the simplest duty calculation.

- You are shipping a low-value item.

- You want to avoid complex courier fees.

Choose a Courier (UPS, FedEx, DHL) if:

- You need fast delivery.

- You are shipping business items.

- You prefer end-to-end tracking.

Tip: Postal is usually cheaper. Couriers are faster but have more fees.

5. Step-by-Step: Shipping from Canada to the U.S. (Using ShipByMail)

- Package your item securely.

- Choose postal or courier based on your needs.

- ShipByMail collects item details (description, value, country of origin) and automatically prepares the customs declaration form. online (description, value, where it was made).

- The system (or Zonos) will show what you must pay.

- Print the label, attach it, and drop off the package.

Final Summary

- De minimis used to mean duty-free under $800, but this now depends on how you ship.

- Tariffs are taxes on imported goods. Couriers use detailed rules; postal uses simpler percentages.

- Zonos helps you see duties before shipping.

- Choosing the right method depends on speed, cost, and simplicity.

Leave a Reply